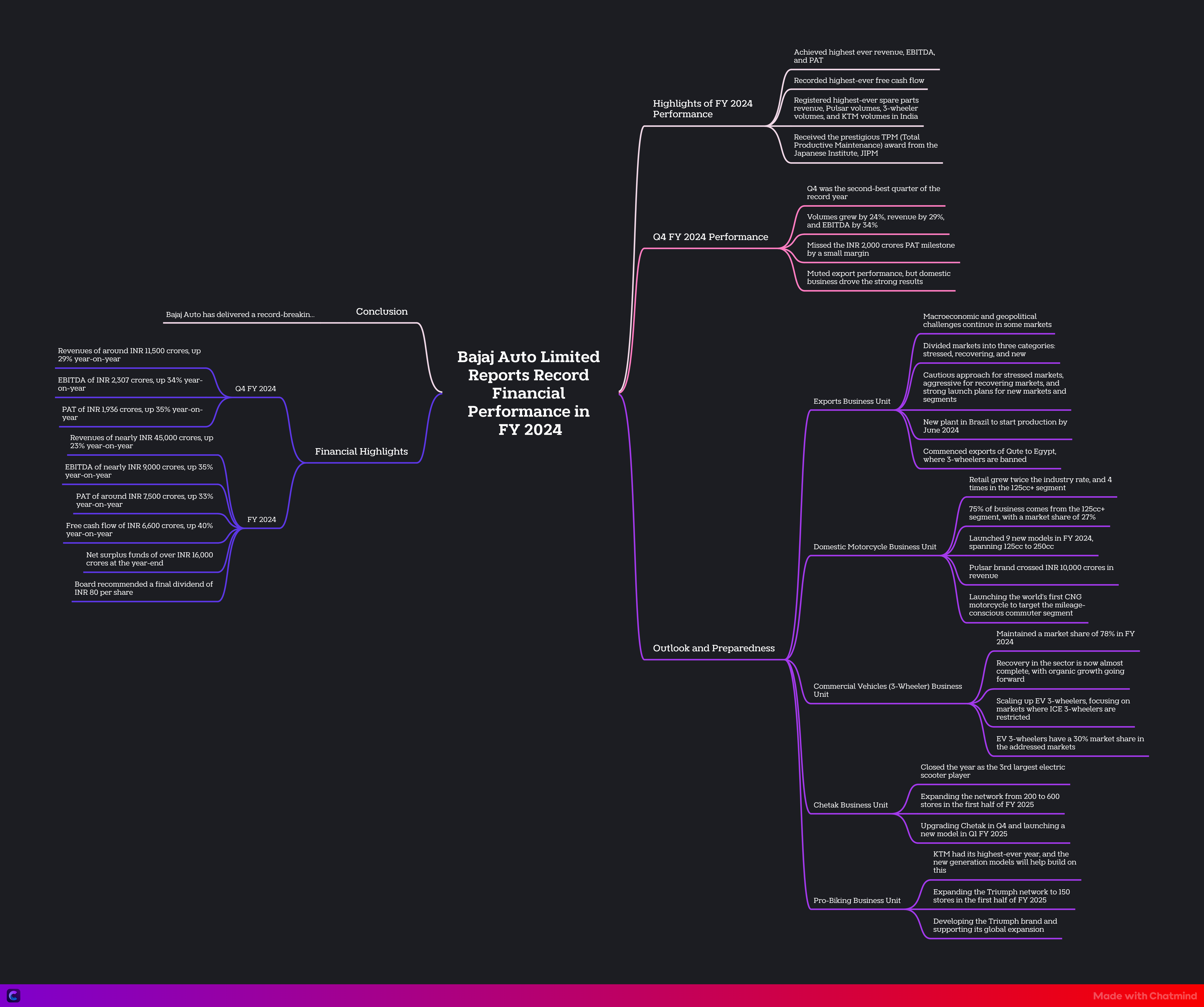

Bajaj Auto Limited reported record-breaking financial performance in FY24, achieving new highs in revenue, EBITDA, PAT, and free cash flow. The company’s domestic and export businesses performed well, with strong growth in the motorcycle, 3-wheeler, and electric vehicle segments. #RecordPerformance #GrowthLeaders

Key highlights:

- Domestic motorcycle business unit witnessed significant growth, driven by successful new launches in the 125cc+ segment, with market share gains. #PulsarBrand #MarketShareGains

- The 3-wheeler business unit maintained its market dominance, with a focus on expanding into electric autos, especially in restricted markets. #3WheelerLeadership #ElectricAutos

- The Chetak electric scooter business gained momentum, with plans for further network expansion and new model launches. #ChetakEV #ElectricMobility

- The company is actively investing in cutting-edge technologies, such as CNG and LFP (Lithium Iron Phosphate) batteries, to drive innovation and differentiation. #TechnologicalInnovation #CNG #LFPBatteries

- Export markets faced challenges due to macroeconomic and geopolitical factors, but the company is optimistic about new market opportunities, such as Egypt’s recognition of quadricycles. #ExportOpportunities #Qute

- Bajaj Auto Credit Limited, the company’s captive finance arm, commenced operations, aiming to expand its presence across the country. #CaptiveFinancing #BusinessExpansion

#BajajAuto #Q4FY24Results #IndustryLeaders #SustainableGrowth